US GDP Surges 3.0% in Q2, Defying Tariff Drag as Imports Collapse

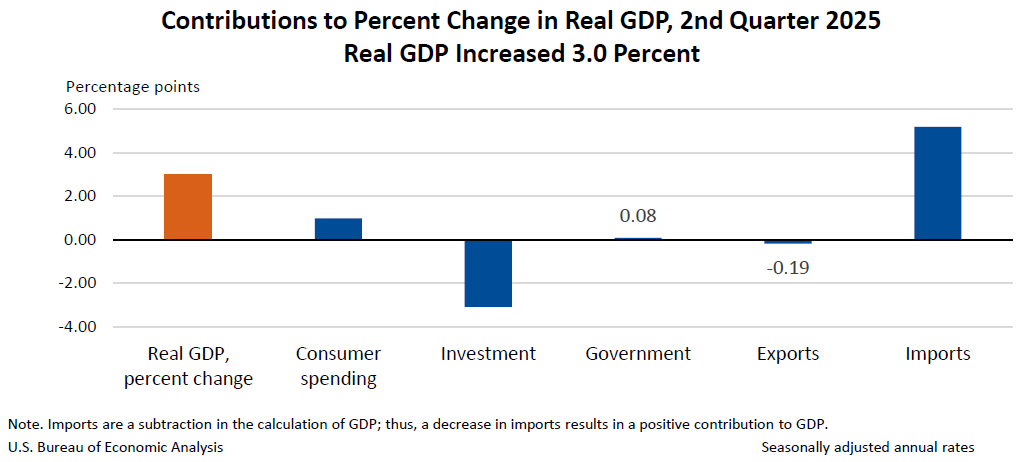

The US economy expanded at a 3.0% annualized pace in the second quarter of 2025, sharply reversing the 0.5% contraction in Q1 and outperforming expectations of 2.3%, according to the advance estimate from the Bureau of Economic Analysis (BEA). The upside surprise was driven primarily by a steep drop in imports and a modest rebound in consumer spending, offsetting declines in investment and exports.

Key Drivers

- Imports plunged 30.3%, reversing a 37.9% surge in Q1, which had been inflated by front-loading ahead of tariff announcements. The sharp fall in imports, which subtract from GDP, provided the largest positive contribution to the headline number.

- Consumer spending rose 1.4%, up from 0.5% in Q1, reflecting steady household demand despite persistent inflationary pressures and elevated borrowing costs.

- Exports fell 1.8%, and residential investment declined 4.6%, pointing to ongoing weakness in housing and external demand.

Underlying Demand Weakens

While the headline GDP print impressed, underlying domestic demand softened. Final sales to private domestic purchasers, a key Fed-watched indicator, rose just 1.2%, down from 1.9% in Q1 — the slowest since Q4 2022. This metric excludes volatile trade and inventory swings and better reflects private-sector momentum.

Market Reaction & Policy Outlook

Markets responded cautiously. Treasury yields ticked higher, and equity futures were mixed as investors weighed resilient growth against softer domestic demand. The Fed, meeting later today, is widely expected to keep rates steady in the 4.25%–4.50% range.

President Trump welcomed the report, posting on Truth Social: “2Q GDP JUST OUT: 3%, WAY BETTER THAN EXPECTED! “Too Late” MUST NOW LOWER THE RATE.” His renewed pressure on the Fed underscores rising political attention on monetary policy amid high mortgage rates and a cooling housing market.

Investor Takeaway

While the headline print signals resilience, especially in trade-adjusted GDP, the softening in final domestic sales suggests the economy may be more fragile beneath the surface. For investors, today’s data tempers recession risks in the near term but supports the case for the Fed to remain patient before considering rate cuts.

Comments ()